TLDR

The Across settlement contract enables Malda to transform fragmented liquidity into a unified, dynamically managed global pool, thereby solving a critical infrastructural challenge in DeFi.

Introduction

In DeFi protocols today, liquidity is trapped in silos across dozens of chains. What if we could coordinate its movement with mathematical precision for maximum gains?

DeFi still suffers from fragmented liquidity, resulting in poor capital efficiency, volatile rates, and a fractured user experience. Malda is tackling this exact foundational issue.

Malda is a Unified Liquidity Lending protocol operating across Ethereum and Layer 2s, delivering a seamless lending experience through global liquidity pools, all secured by zero-knowledge proofs (zkProofs). As the first DeFi protocol built fully on zkCoprocessor technology, Malda creates unified pools within the wider Ethereum ecosystem that act in sync to provide uninterrupted money market services, effectively solving the problem of liquidity fragmentation.

Across empowers protocols like Malda to achieve optimal capital efficiency through intents-based settlement, enabling seamless liquidity rebalancing across multiple chains without user friction.

Let’s explore some technical nuances about the integration between Across and Malda and how this integration sets a new benchmark for crosschain DeFi.

What is Malda?

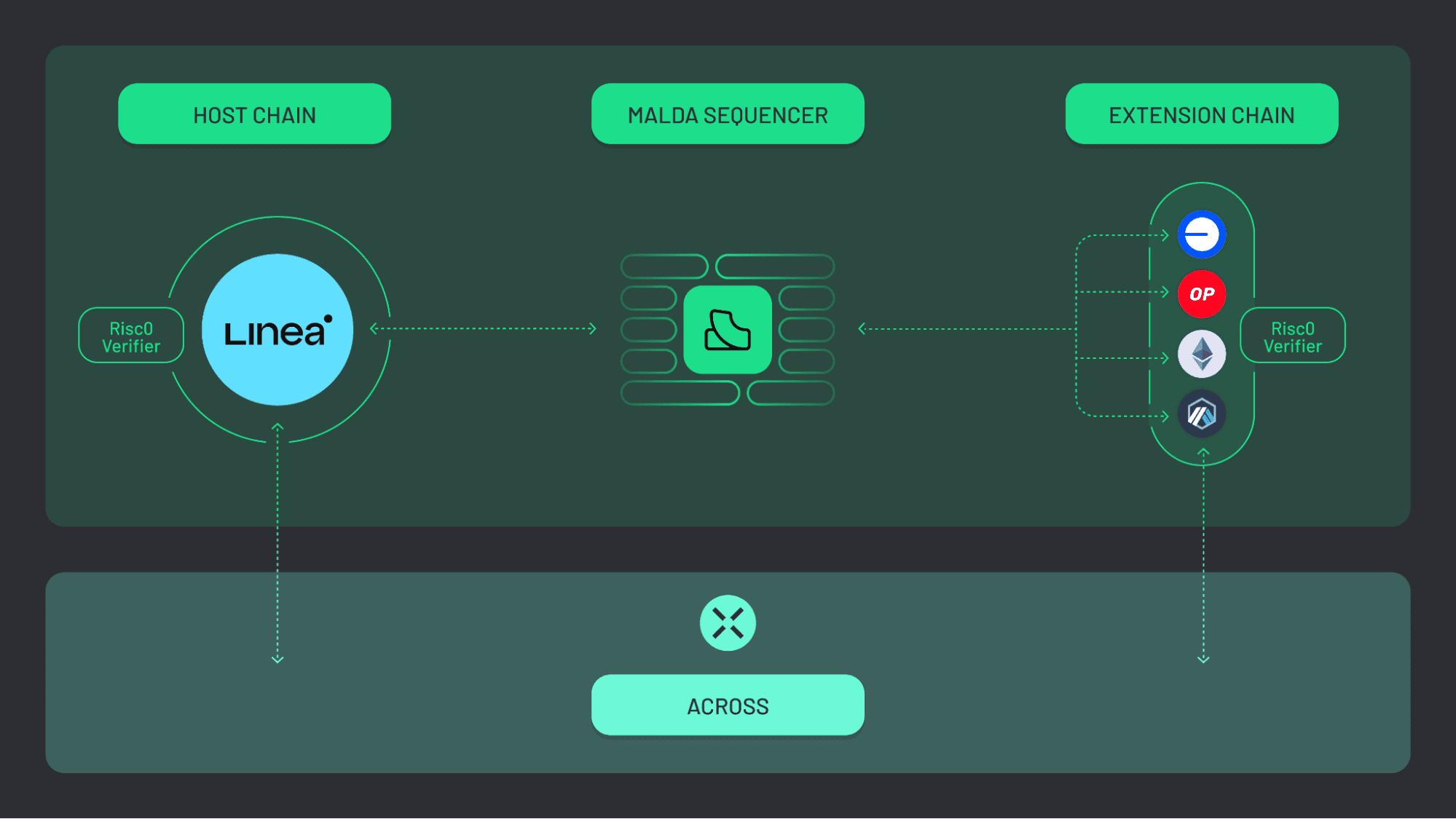

Malda is the first DeFi protocol that uses zkCoprocessor technology to unify lending pools across multiple Ethereum-based chains. Unlike traditional protocols that deploy siloed pools on each chain, Malda maintains a single, consistent ledger on its Host Chain (Linea) while offloading all computation, including interest rate logic and balance updates, to a zkVM.

Key architectural features include:

Host/Extension Chain Design: Linea serves as the zk-finality anchor, while other L2s, such as Base and Optimism, act as Extension Chains with state updates verified onchain via zk-proofs.

zk-based Accounting: All supply, borrow, and repayment actions generate proofs validated by the RiscZero Verifier deployed on all chains.

User Self-Sequencing: Users can bypass the Malda sequencer if needed, generating and submitting their own zk-proofs.

zkVM Computation Pipeline: Interest rate curves, utilization metrics, and borrow accounting are all computed off-chain and proven via zk.

Supporting Malda’s unified multichain vision needs a settlement system that can move capital intelligently based on user intents in almost real-time. This is where the Across settlement contract comes in.

Understanding the Across Settlement Contract

The Across settlement contract is the only production-ready modular layer for fast, low-cost crosschain Intents and seamless interoperability. Unlike traditional bridges that just move tokens, Across' settlement contract coordinates which relayer fulfills what Intent, where, and when abstracting the execution complexity from applications like Malda.

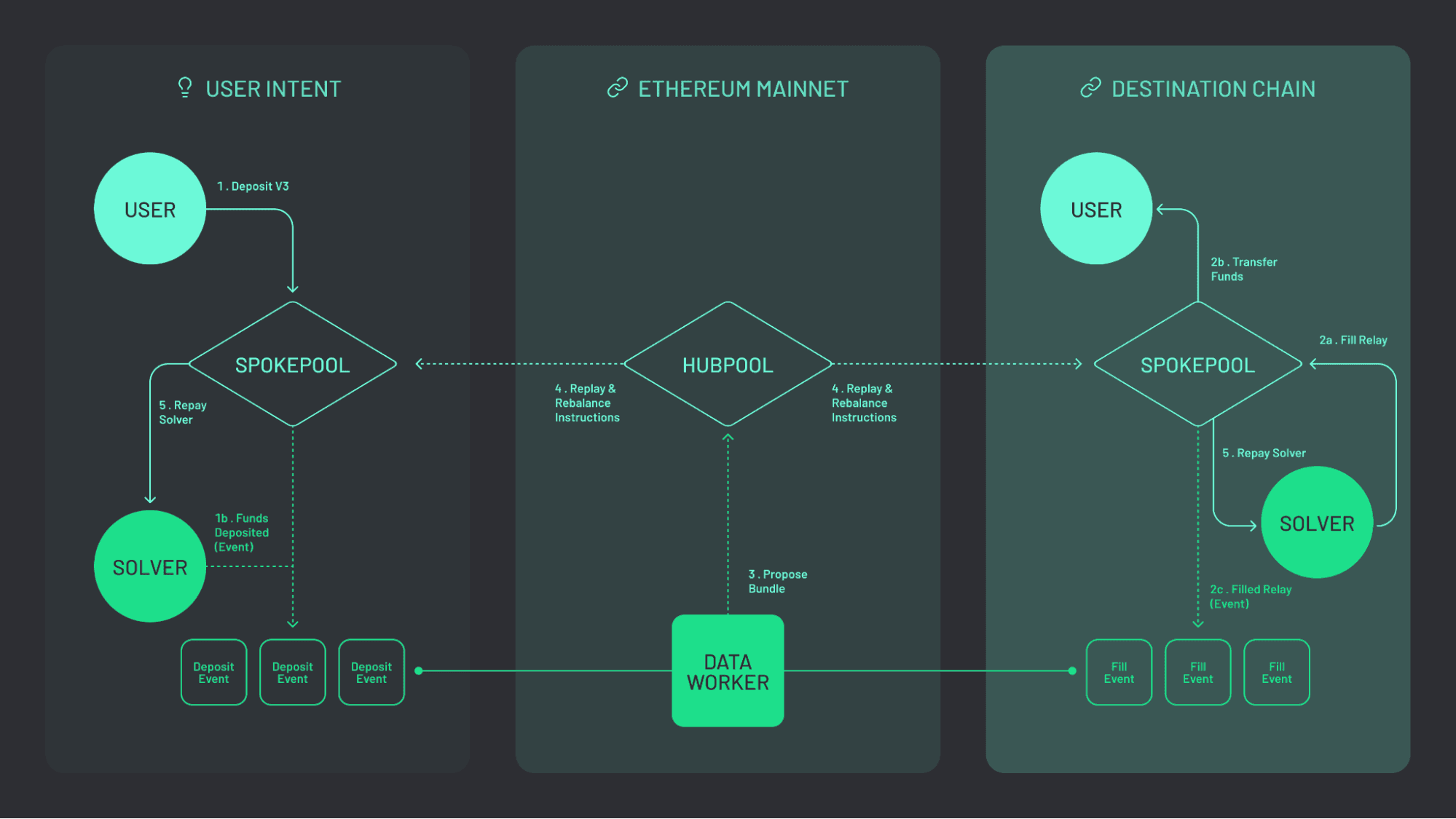

At its core, Across implements a Hub and Spoke model:

Spoke Pools: Smart contracts deployed on each supported chain that handle user deposits and relayer fills.

Hub Pool: A central contract on Ethereum that manages protocol liquidity and relayer repayments.

Intent Settlement System: The infrastructure that matches Intents with relayers who fulfill them across chains.

This architecture provides several key advantages for protocols like Malda that need to manage liquidity across multiple networks:

Optimistic Verification: Across aggregates valid fills offchain to create repayment bundles verified by UMA's optimistic oracle, scaling gas costs at O(1) instead of O(N) with the number of fills.

High-Speed Bridging: Allows for user intents to be filled in almost real-time, providing a seamless UX, perfect for Malda.

Flexible Settlement: Relayers can receive repayment on their chain of choice, reducing the overhead of managing crosschain positions.

Now that we have laid the groundwork on how Across' settlement contract works, let’s dive deeper into the technical nuances of how Malda utilizes Across' settlement contract.

How Malda Leverages Across

Phase 1: Protocol-Level Rebalancing (Live at Launch)

At launch, Malda integrates Across as a backend settlement layer to perform daily USDC rebalancing across supported chains: Linea, Base, and Ethereum Mainnet.

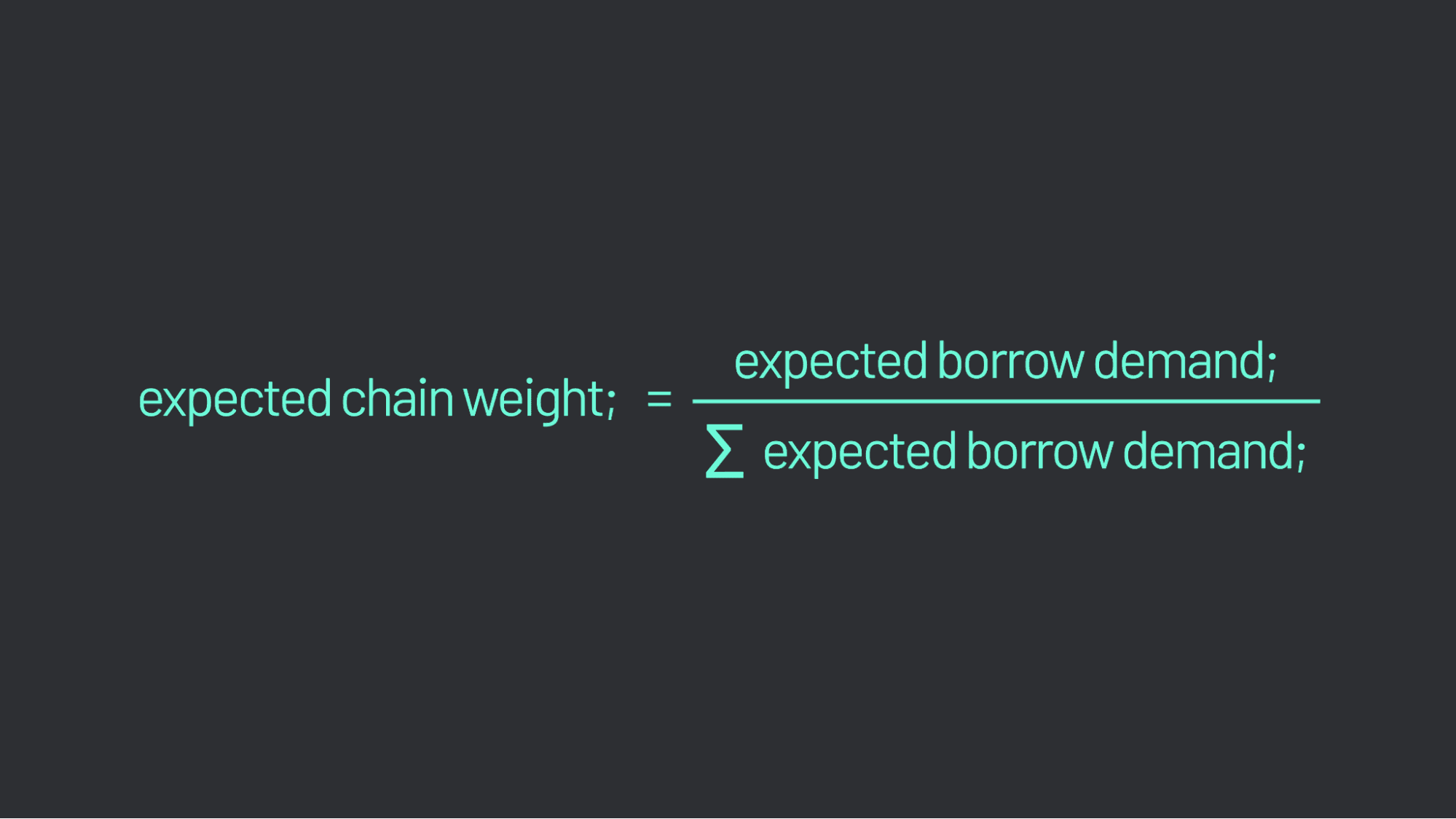

Malda uses a linear regression-based model to forecast borrow demand on each chain over a 7-day horizon. This model calculates the expected demand per chain and assigns target weights to rebalance liquidity proportionally:

A rebalance is triggered when the deviation between expected and current weight exceeds 20%. When triggered, liquidity is moved across chains using Across, minimizing the delta between current and ideal distribution.

Key advantages of using Across here include:

Efficient and secure bridging that ensures protocol health.

Near instant intent fills via relayers.

Modular, programmatic control over settlement execution, focusing on local pools.

This enables Malda to unify liquidity across chains and ensure optimal utilization without user involvement or inefficient over-provisioning. Across and Malda work hand-in-hand to ensure a one-click user experience while maintaining verifiability and security.

Phase 2: Intents-Based Large Borrow Fulfillment (Coming Soon)

In the second phase, Malda will introduce a new paradigm: fulfilling large user borrow requests via intents-based crosschain settlement.

For example, if a user submits a borrow request for 8M USDC on Base, but the local pool only has 5M available, the protocol can initiate an intent to fulfill the borrow using liquidity from Linea or Ethereum Mainnet. The request includes an acceptable range (e.g., “I’m okay with 7.5M”), and Across is used to settle the difference by bridging USDC just in time.

This is known as on-demand liquidity sourcing for large, user-initiated borrow transactions. It represents how the combination of Malda's zkProof infrastructure and Across' intents settlement layer enables sophisticated financial operations that would be impossible with traditional single-chain lending protocols.

As we emphasized in Phase 1, the user never interacts with the bridge. The Malda protocol handles everything under the hood, ensuring a one-click user experience while maintaining verifiability and security. This is going to be an upcoming theme in DeFi protocols that prioritize and build a unified UX.

Major Takeaways from Malda’s Technical Architecture

Malda is setting a new standard for how modular, verifiable DeFi infrastructure should look. Its architecture brings components together that unlock true crosschain capital efficiency.

zkVM Coprocessor: Offchain lending logic runs in a RiscZero zkVM, ensuring all computations are provable and verifiable onchain.

Host/Extension Model: Linea acts as the zk-verified Host Chain, while Extension Chains handle fast, local UX.

State Sync via ZK-Proofs: Extension Chains post ZK-proofs to maintain global consistency and prevent double-borrows.

Intents-Based Liquidity Routing: Large borrows trigger intents from the Host Chain, fulfilled via Across without user friction.

Malda proves how zk + intents + modular settlement unlock unified, efficient crosschain liquidity.

The Bigger Picture

Malda is the first DeFi protocol built fully on a zkCoprocessor technology to create unified pools within the wider Ethereum ecosystem that act in sync to provide uninterrupted money market services solving the problem of liquidity fragmentation.

By combining zkProof security with Across' settlement contract, Malda:

Eliminates liquidity fragmentation.

Enables deep crosschain capital efficiency.

Proves the viability of intents for real-world financial infrastructure.

We believe this model will become the new standard for how crosschain DeFi protocols operate.

The Across Advantage

Across' settlement contract is purpose-built for crosschain intents. Its optimistic architecture, solver-based fulfillment, and native support for programmatic liquidity management make it uniquely suited for a use case like Malda.

With this integration:

Liquidity is rebalanced across chains in real-time with minimal slippage.

Large user requests can be fulfilled without needing local capital over-provisioning.

The protocol operates efficiently across multiple chains with unified liquidity.

This sets a new benchmark for what a truly scalable, chain-agnostic lending protocol can look like.

Build With Across

If you're building a crosschain DeFi application, Across offers a modular settlement layer designed for Intents-based interoperability. Malda’s implementation proves how powerful and production-ready this can be, from backend liquidity rebalancing to seamless user-facing fulfillment.

Want to build something innovative with Across?